[ad_1]

In February and March 2024, ScholarshipOwl conducted a survey to help us to gain a deeper understanding of how the rollout of the new Free Application for Federal Student Aid (FAFSA) has impacted Gen Z students. Media outlets have reported on a number of issues with the rollout of the new FAFSA that have resulted in delays with students submitting the FAFSA, as well as delays with students receiving financial aid offers from colleges. According to the National College Attainment Network’s FAFSA Tracker, just 34% of this year’s high school seniors had submitted the new FAFSA as of March 22, 2024, which is down 29% compared to last year. In addition, technical issues have caused multiple delays in transmitting accurate student data to the colleges, preventing colleges from being able to send financial aid offers to students. All of this has created a snowball effect that is widely expected to lead to a significant drop in college enrollment for the 2024-25 school year and beyond. Based on this, our survey results were not surprising, but they were sobering, with 21% of FAFSA-eligible students indicating they haven’t yet submitted the new FAFSA for 2024-25. Of the students who have successfully submitted their FAFSA for the 2024-25 school year, just 16% had received at least one financial aid offer from a college.

Who participated in the survey?

In February and March 2024, ScholarshipOwl surveyed high school and college students on the ScholarshipOwl scholarship platform to learn about how the rollout of the new FAFSA has impacted them. A total of 11,394 students responded.

Among the respondents, 62% were female, 36% were male, and 2% identified themselves as other. Nearly half (47%) were Caucasian, 21% were Black, 17% were Hispanic/Latino, 7% were Asian/Pacific Islander and 6% identified as other.

The fastest path to earning scholarships

Simplify and focus your application process with the one-stop platform for vetted scholarships.

Check for scholarships

Over half (58%) of the respondents were high school students, with the vast majority high school seniors; one-third (33%) were college undergraduate students, primarily college freshmen and college sophomores; 6% were graduate students and 3% identified themselves as adult/non-traditional students.

Survey questions

Question 1

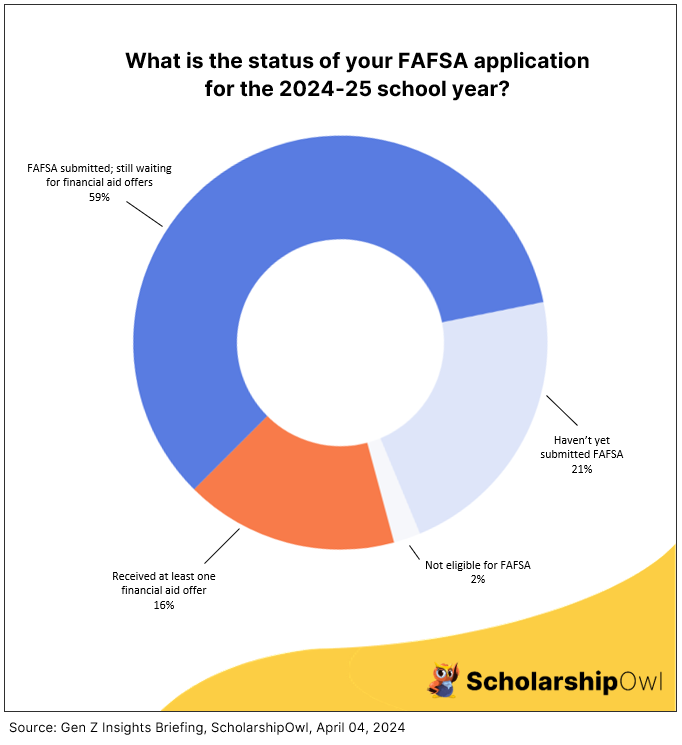

We began the survey by asking students, “What is the status of your FAFSA application for the 2024-25 school year?”

16% said they had submitted the FAFSA and have already received one or more financial aid offers;

57% said they had submitted the FAFSA, but they have not yet received any financial aid offers;

21% said they will be attending college in 2024-25, but they haven’t yet submitted the FAFSA;

3% said they won’t be attending college in 2024-25, so they won’t be submitting the FAFSA;

2% said they they are not eligible to submit the FAFSA because they are not a U.S. Citizen or Permanent Resident

Question 2

The next question was, “If you have received one or more financial aid offers from colleges for the 2024-25 school year already, which of the following were included in your financial aid offer(s)? Select all that apply.”

64% said they have not yet received any financial aid or scholarship offers for 2024-25;

11% said they were offered a Pell Grant and/or other federal grant(s);

8% said they were offered grant(s) or scholarship(s) from their state of residence;

21% said they were offered university grant(s) or scholarship(s);

3% said they were offered private/external scholarship(s);

3% said they were offered federal work-study;

2% said their parents were offered a Parent Plus loan;

3% said they won’t be attending college in 2024-25.

Question 3

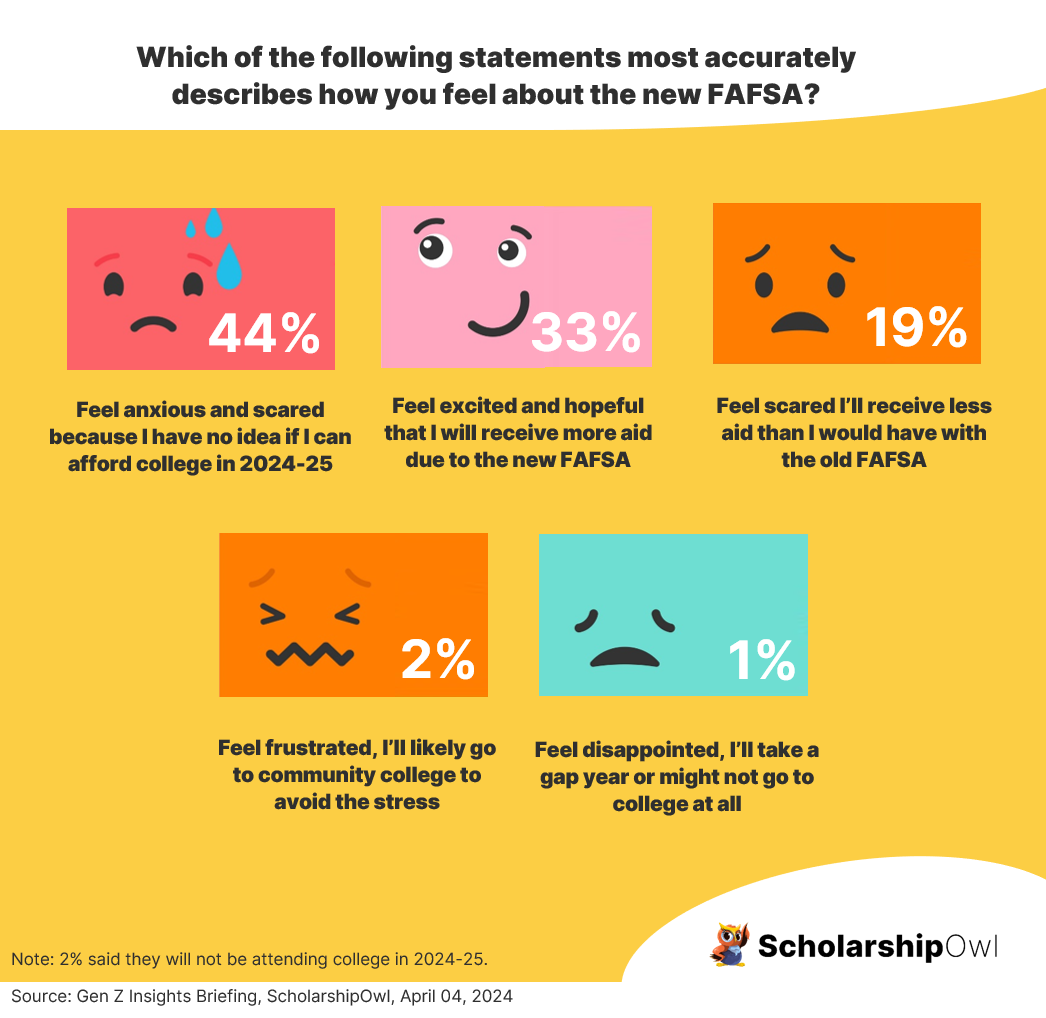

Of the 11,394 students who participated in our survey, 7764 students responded to an add-on question: “Which one of the following statements most accurately describes how you feel about the changes to the FAFSA?”

44% said they feel anxious because they have no idea if they will be able to afford college in 2024-25;

33% said they are excited and hopeful that they will receive more aid due to the new FAFSA;

19% said they feel scared that they will receive less aid than they would have with the old FAFSA;

2% said they feel frustrated, and that they will likely go to community college to avoid the stress;

1% said they feel disappointed, and that they are planning to take a gap year or possibly not go to college at all;

2% said they won’t be attending college in 2023-25.

Key takeaways

The results of our survey indicate that much of what media outlets are reporting is true – even among our students who are focused on applying for scholarships, there are a significant number (21%) who haven’t yet submitted the new FAFSA for the 2024-25 school year. Among our students who have already submitted the FAFSA, just 16% have received at least one financial aid offer from a college. And while one-third (33%) of the students said they are excited and hopeful that they will receive more aid due to the new FAFSA, this pales in comparison to the two-thirds (66%) who say they feel anxious, scared, frustrated, or disappointed about the new FAFSA.

What can students do to ensure they can afford college, despite all of the challenges with the new FAFSA?

There are a number of steps that students can take to ensure they have an affordable path to college:

If you plan to attend college in 2024-25, it is imperative that you submit your FAFSA right away. If you haven’t yet, submit it today at www.fafsa.gov.

Contact your college and/or all of the colleges who have offered you admission, and ask them for a status on your financial aid offer. Ask them if there is any information or documentation that you can submit that will make it easier for them to get their financial aid offer to you.

Prioritize applying for scholarships with ScholarshipOwl.

Apply for scholarships from the universities you are applying for and/or are currently attending; if you’ve already applied for these scholarships, contact the financial aid office to ask for a status on your application.

Work part-time during the school year and full-time during breaks. Save your earnings to use for your college education.

Once you do receive your financial aid offers, compare them and focus on choosing the most affordable college. If your first-choice school offered you a less financial aid and scholarships than other schools offered, contact your preferred school to see if you can negotiate your offer to one that is more affordable for you.

Always consider starting at a community college, which offers a truly affordable option – and don’t forget that community colleges also offer federal and state grant aid, and they also offer scholarships. So even if you are planning to attend community college, always submit your FAFSA and always apply for scholarships!

REMEMBER: Student loans should always be a last-resort option for paying for college. Focus on debt-free sources that will enable you to graduate without the burden of owing thousands of dollars for college! Focus on applying for scholarships and jobs, NOT loans, so that you can graduate debt-free. There IS an affordable path to college – for further information, and to start applying for scholarships, visit www.scholarshipowl.com.

[ad_2]

Source link