[ad_1]

Every month, ScholarshipOwl conducts surveys to help us to gain a deeper understanding of Gen Z, especially regarding their readiness for college. Given the current economic conditions, we decided to focus last month’s survey on students’ ability to afford college in the coming school year. We had anticipated that the majority of students would not yet have the funds needed, but we were stunned to learn that over half (56%) of the students said that they have not yet secured any funds at all from scholarships, federal or state grants, income from a job, personal savings or funds from family for college next year.

Who participated in the survey?

In January 2024, ScholarshipOwl surveyed high school and college students on the ScholarshipOwl scholarship platform to learn more about their views about the value of college. A total of 9,762 students responded.

Among the respondents, 60% were female, 39% were male, and 1% identified themselves as other. Nearly half (47%) were Caucasian, 21% were Black, 18% were Hispanic/Latino, 6% were Asian/Pacific Islander and 6% identified as other.

The fastest path to earning scholarships

Simplify and focus your application process with the one-stop platform for vetted scholarships.

Check for scholarships

Nearly two-thirds (61%) of the respondents were high school students, with the vast majority high school seniors; nearly one-third (32%) were college undergraduate students, primarily college freshmen and college sophomores; 6% were graduate students and 2% identified themselves as adult/non-traditional students.

Survey questions

Question 1

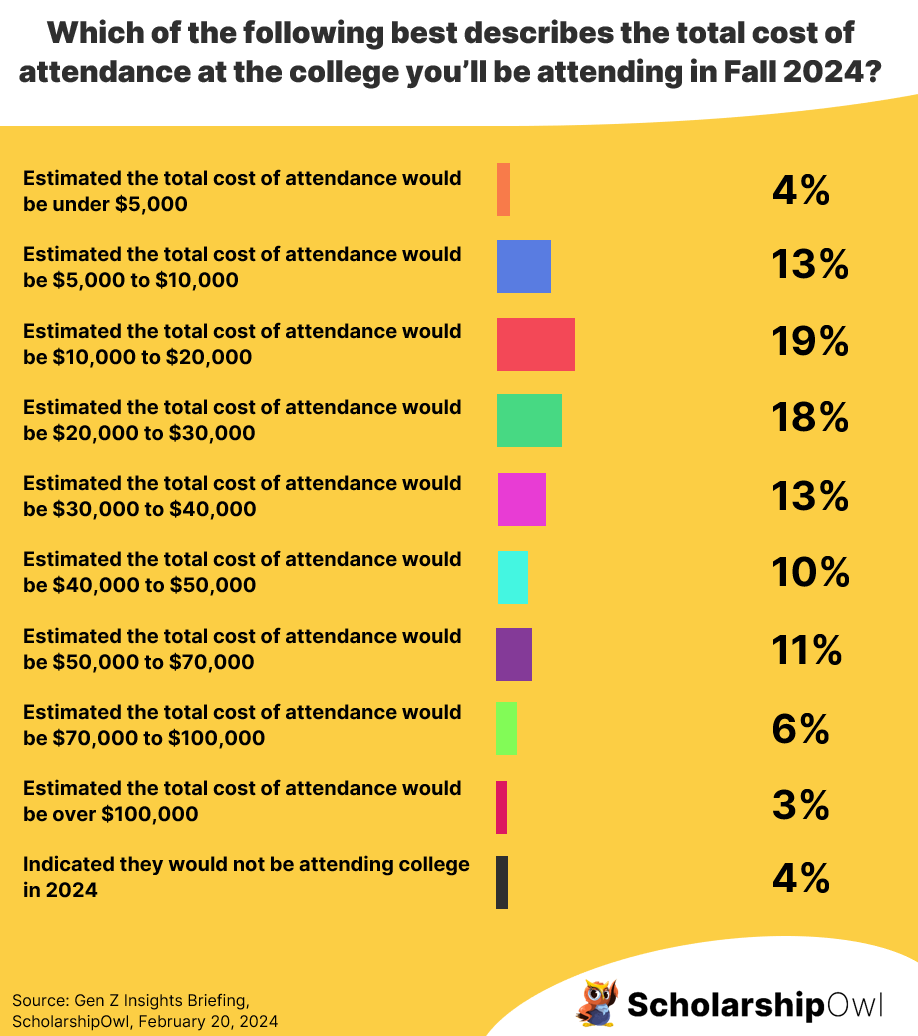

We began the survey by asking students, “Which of the following best describes the total cost of attendance (tuition & fees, room & board, books/supplies, etc) at the college you’ll be attending in Fall 2024?”

4% said the total cost of attendance would be under $5,000

13% said the total cost of attendance would be $5,000 to $10,000

19% said the total cost of attendance would be $10,000 to $20,000

18% said the total cost of attendance would be $20,000 to $30,000

13% said the total cost of attendance would be $30,000 to $40,000

10% said the total cost of attendance would be $40,000 to $50,000

11% said the total cost of attendance would be $50,000 to $70,000

6% said the total cost of attendance would be $70,000 to $100,000

3% said the total cost of attendance would be over $100,000

4% indicated that they would not be attending college in Fall 2024

Question 2

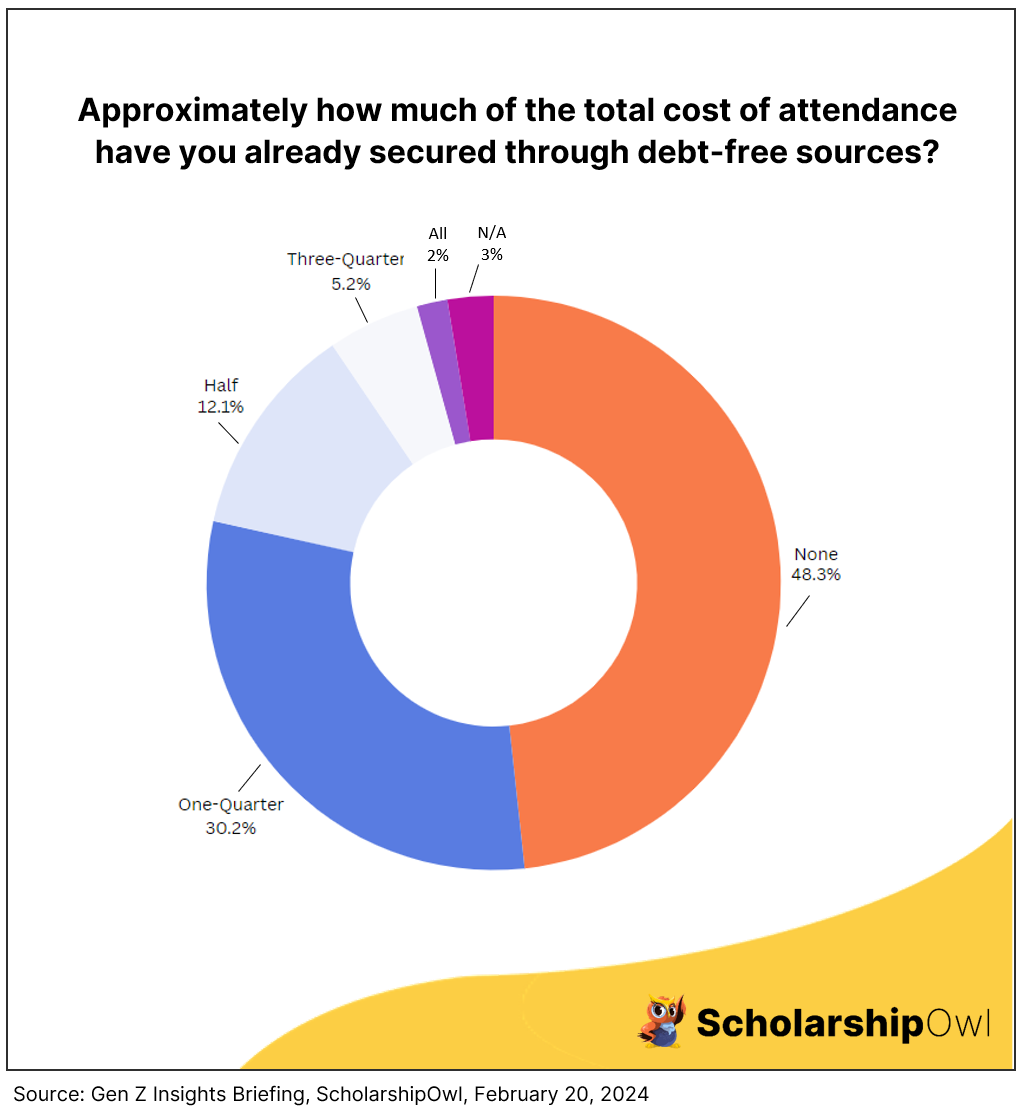

The next question was, “Approximately how much of the Fall 2024 total cost of attendance have you already secured through debt-free sources such as scholarships, federal and/or state grants, income from a job, savings, money from family, etc?”

56% said they have none of the funds needed

35% said they have one-quarter of the funds needed

14% said they have half of the funds needed

6% said they have three-quarters of the funds needed

2% said they have all of the funds needed

3% said they would not be attending college in Fall 2024

Question 3

Our final question was, “Which of the following sources do you expect you’ll use the most to cover the rest of your college costs?” Students were able to select just one answer.

16% selected need-based federal and/or state grants

15% selected scholarships from their college/university

11% selected external/private scholarships

1% selected federal work-study

15% selected income from a job

3% selected savings

8% said they would ask parents/family to provide additional financial support

26% selected student loans

2% selected private loans

Less than 1% said they already have all of their college costs covered

3% said they would not be attending college in Fall 2024

Key takeaways

Based on this survey, it is clear that the majority of students need to be educated regarding the actual cost of college. The average cost of attending an in-state public university is about $26,000 per year; attending an out-of-state university or private college can cost anywhere from $40,000 to $70,000 per year. Yet over one-third (36%) of the students responding to this survey expect that the total cost of attendance for their college next year will be under $20,000.

It was also an eye-opener to discover that more than half of the students surveyed (56%) say they have not yet secured any debt-free funds for college next year. Perhaps some of these students may not be aware of college funds that their families have started for them, but even if that is true, far too many of the respondents have no idea how they will be able to pay for college next year.

While not surprising, it was still disappointing to learn that nearly one-third of students are planning to “fund their financial aid gap” with loans as their primary funding source. With so many options for debt-free sources to pay for college, students and families need to consider loans as last-resort funds, rather than a go-to choice.

Where can students and families learn more about the cost of college?

Every college lists the total cost of attendance on their website. Sometimes this information can be a bit hard to find. The easiest way to jump to this information is to search for “total cost of attendance” in the website’s search bar.

General information about the average total cost of attendance of colleges can also be found on the Education Data Initiative website.

What are some debt-free sources students can access to pay for college?

Student loans should always be a last-resort option for paying for college. Focus on debt-free sources that will enable you to graduate without the burden of owing thousands of dollars for college. Here is how students can pay for college without loans:

Access federal and state grant aid by submitting the FAFSA.

Prioritize applying for scholarships with ScholarshipOwl.

Apply for scholarships from the universities you are applying for and/or are currently attending.

Work part-time during the school year and full-time during breaks. Save your earnings to use for your college education.

Choose a more affordable path to college, such as by starting at a community college.

Parents and school counselors need to encourage students to apply for scholarships and jobs, NOT loans, enabling students to graduate debt-free. There IS an affordable path to college – for further information, and to start applying for scholarships, visit www.scholarshipowl.com.

[ad_2]

Source link